idaho vehicle sales tax calculator

Get an Idaho sales tax permit before the motor vehicle can be registered in Idaho. So whilst the Sales Tax Rate in Idaho is 6 you can actually pay anywhere between 6 and 9 depending on the local sales tax rate applied in the municipality.

States With Highest And Lowest Sales Tax Rates

With local taxes the total sales tax rate is between 6000 and 8500.

. Idaho sales tax applies to the sale rental or lease of most goods and some services. You are able to use our Idaho State Tax Calculator to calculate your total tax costs in the tax year 202122. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

The customer paid sales tax on the buyout of the lease. See how we can help improve your knowledge of Math Physics Tax Engineering and more. With local taxes the total sales tax rate is between 6000 and 8500.

For example imagine you are purchasing a vehicle for 60000 with the state sales tax of 6. This guide is for individuals leasing companies nonprofit organizations or any other type of business that isnt a motor vehicle dealer registered in Idaho. 8 rows Sales or use tax is due on the sale lease rental transfer donation or use of off-highway vehicles in Idaho unless a valid exemption applies.

The state sales tax rate in Idaho is 6000. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Temporary lodging 30 days or less is taxed.

Food is taxed in Idaho though low-income taxpayers may be eligible for a tax credit to offset the cost of sales taxes paid on food purchases. Average DMV fees in Idaho on a new-car purchase add up to 92 1 which includes the title registration and plate fees shown above. One of a suite of free online calculators provided by the team at iCalculator.

This guide is for individuals leasing companies nonprofit organizations or any other type of business that isnt a motor. This page describes the taxability of leases and rentals in Idaho including motor vehicles and tangible media property. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately. Idaho has a 6 statewide sales tax rate but also has 112 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top of. Car Tax By State Usa Manual Car Sales Tax Calculator Dmv Idaho Transportation Department Dmv Idaho Transportation Department Idaho Who Pays 6th Edition Itep Idaho Sales Tax Fill Online Printable Fillable Blank Pdffiller Share this.

However certain products or services in Idaho can have a higher or lower tax. Paid directly to the dealer and. Car Tax By State Usa Manual Car Sales Tax Calculator Paid directly to the dealer and.

You can change the default tax rate TAX Percentage in our calculator above if necessary. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Out-of-state companies that lease motor vehicles in Idaho must follow all these requirements.

Calculating Sales Tax Summary. How to Calculate Idaho Sales Tax on a Car. Idaho Documentation Fees.

Please select a specific location in Idaho from the list below for specific Idaho Sales Tax Rates for each location in 2022 or calculate the Sales Tax. Find your state below to determine the total cost of your new car including the. Sales or use tax is due on the sale lease rental transfer donation or use of a motor vehicle in Idaho unless a valid exemption applies.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. You calculate the taxable sales price for a lease of a motor vehicle the same as the sale of a motor vehicle. Make sure the retailer writes its sellers permit number on the title.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Idaho local counties cities and special taxation districts. Make sure the retailer gives you a completed title to the motor vehicle and a detailed bill of sal e showing you paid tax. Pay the Idaho retailer tax on the sales price of the motor vehicle.

The retailer will forward the tax to the Tax Commission. Our calculator has been specially developed in order to provide the users of the calculator with not only how. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR.

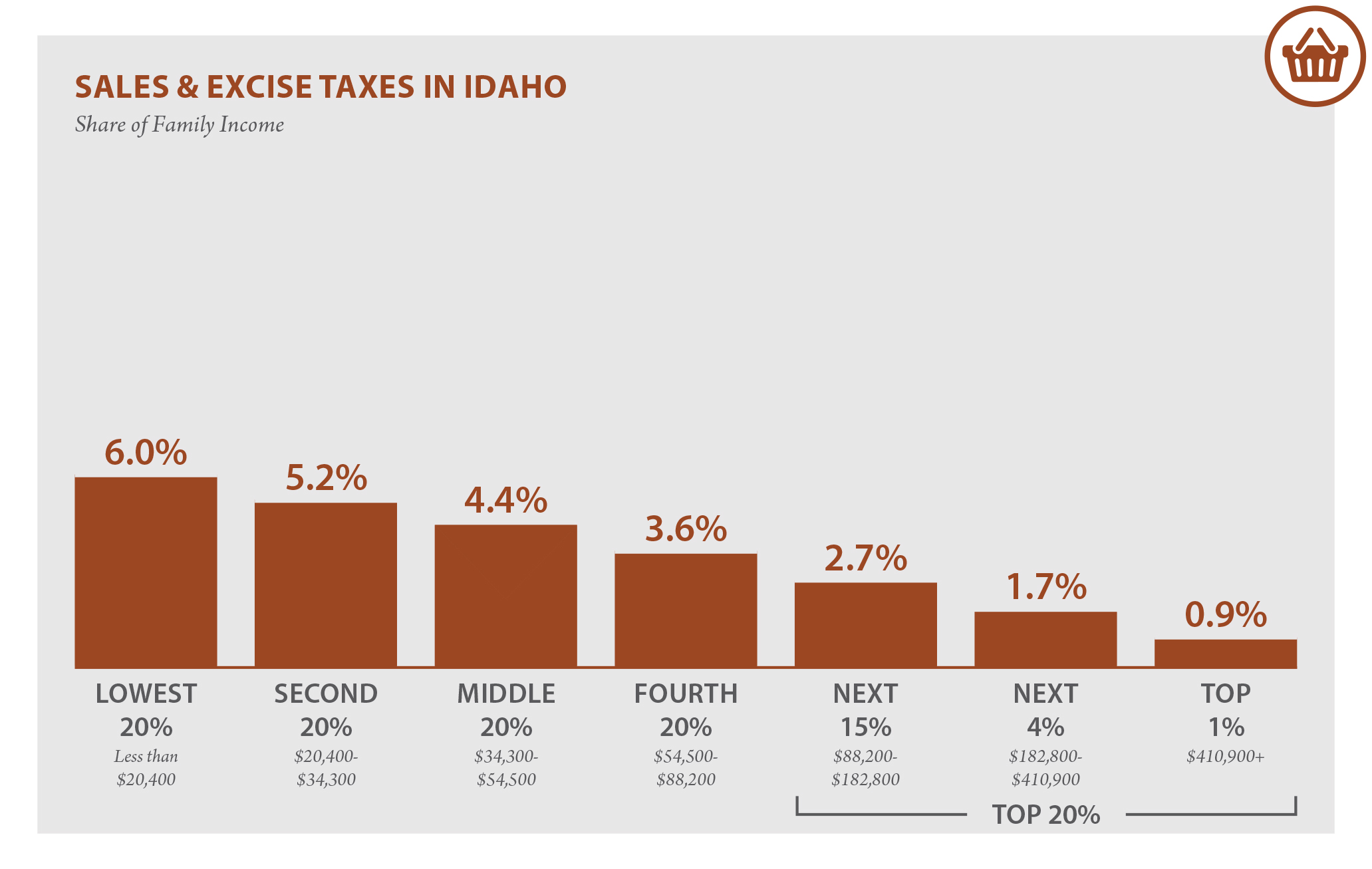

This guide explains sales and use tax requirements for buyers and sellers of off-highway vehicles that are. It is 5139 of the total taxes 53 billion raised in Idaho. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

The Idaho Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Idaho in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Idaho. Prescription drugs however are exempt from sales taxes. It explains sales and use tax requirements for those who buy or receive a.

You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Sales Tax Rate s c l sr. The customer has paid the lease in full.

A leased vehicle you accept as a trade-in for a new purchase or lease reduces the sales price only if both these criteria are met. These fees are separate from. A manufacturers rebate reduces the sales price if its.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. To learn more see a full list of taxable and tax-exempt items in Idaho. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees.

Idaho has recent rate changes Fri Jan 01 2021. Sales and Gross Receipts Taxes in Idaho amounts to 27 billion. The 6 percent sales tax is the most common tax percent for products and services in Idaho.

While Idahos sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

What S The Car Sales Tax In Each State Find The Best Car Price

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Dmv Fees By State Usa Manual Car Registration Calculator

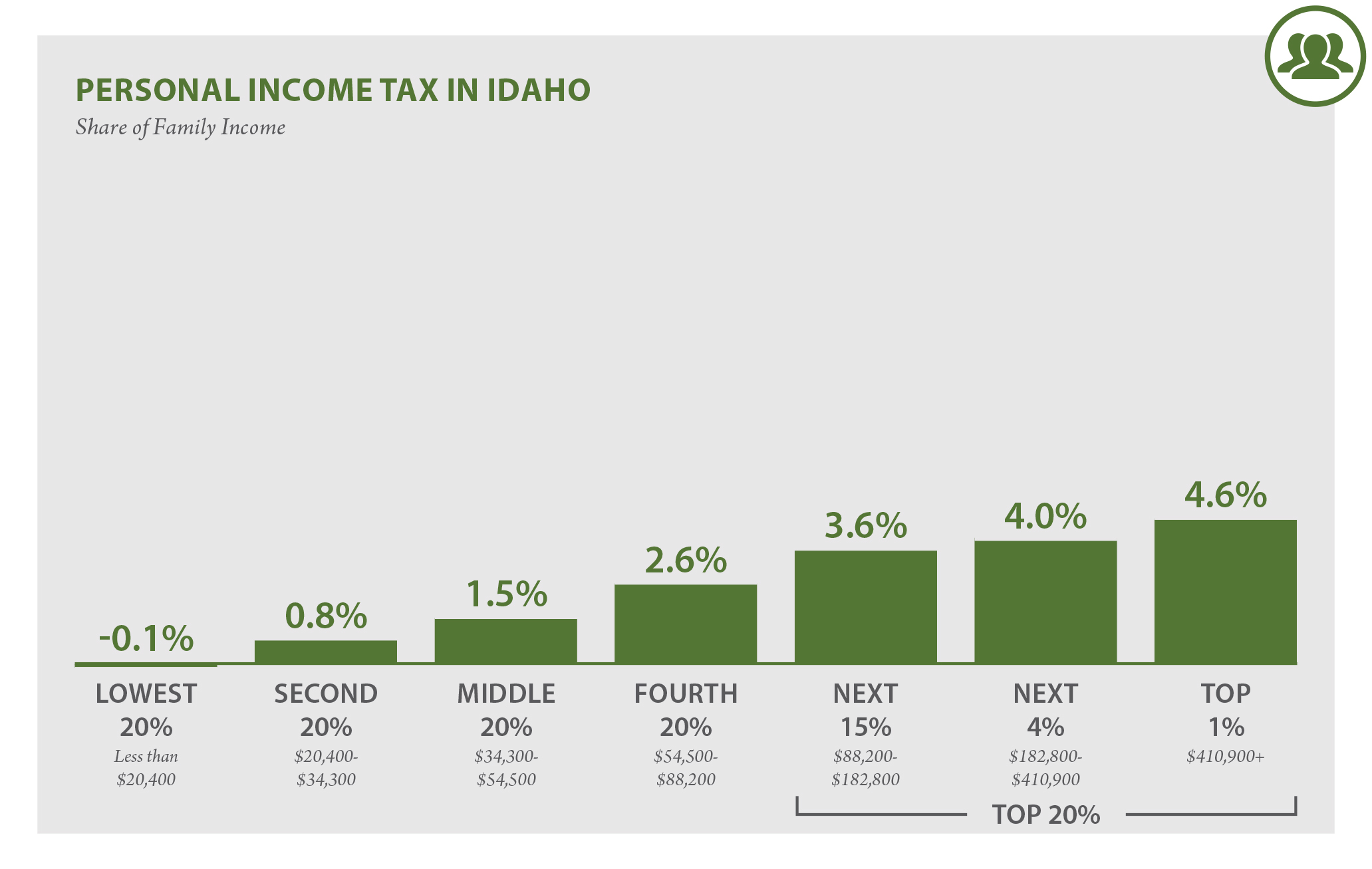

Idaho Who Pays 6th Edition Itep

Idaho Cigarette And Tobacco Taxes For 2022

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Dmv Idaho Transportation Department

Dmv Idaho Transportation Department

Dmv Idaho Transportation Department

What S The Car Sales Tax In Each State Find The Best Car Price

Idaho Who Pays 6th Edition Itep

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Idaho Transportation Department

Idaho Sales Tax Guide And Calculator 2022 Taxjar

Car Tax By State Usa Manual Car Sales Tax Calculator

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Idaho Sales Tax Fill Online Printable Fillable Blank Pdffiller